Award-winning PDF software

Road tax Form: What You Should Know

File Form 2290 (Heavy Vehicle Use Tax)? California's residents only. Vehicles that you are registering in your name on behalf of your business, LLC, corporation, or LLC-partners. Vehicles with a gross weight that is greater than 55,000 pounds. Heavy HUT is an annual tax on the sale and registration of heavy equipment. Heavy equipment is defined as: vehicles, buses, motor homes, recreational vehicles, construction machinery, and similar vehicles. Heavy road vehicles or equipment that are used exclusively on highways are not heavy equipment as defined. If you own heavy equipment, then you must register the equipment for tax purposes. Heavy HUT is not imposed on private passenger vehicles or motor homes, or recreational vehicles that are manufactured, used, or stored out of state. It is also not imposed on trailers, semitrailers, other motorized wheelchair motor cars, motorcycles, or other farm-related vehicles. Why You Make the Payment for Your Vehicle Use Tax Return? You must make the payment before we can release your tax return. If we do not release your return, and you want to file it the next business day, make the payment on time. If you do not have your cash, you must pay for your tax return on or before the due date. You are limited to making the payment for each vehicle for which you register each year. Payments made with a credit card must be made within 20 days from the due date of the return. Payments made with a debit card may be due sooner. Note: Taxpayers in the states of California, Connecticut, and New York are exempt from paying HUT. However, they do not have to file a return. What You Can Expect on Your Return? The California sales tax applies. The HUT is assessed on your sales price. If you do not pay the HUT, then you may have to pay a late filing penalty. If HUT is not paid, we may ask to see a copy of your registration and registration certificate and a copy of the statement or documentation proving that you paid the HUT. For California residents only: A receipt stating that you have made payment. A check or money order (with your credit card or debit card information) made out directly to the Tax Collector with the payee name and contact number where the payment was made. A 15.00 handling fee may be applied to checks or money orders.

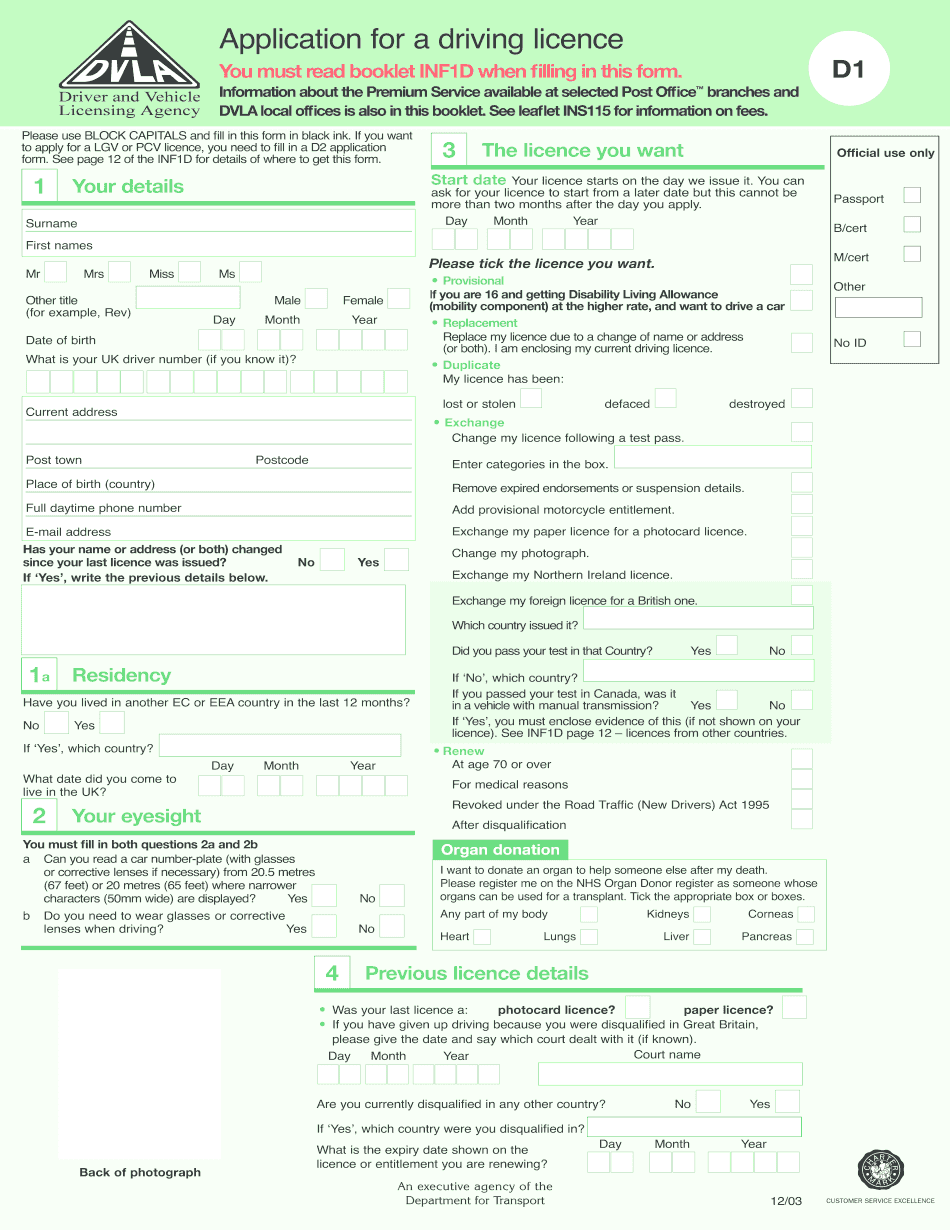

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do UK Dvla D1, steer clear of blunders along with furnish it in a timely manner:

How to complete any UK Dvla D1 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your UK Dvla D1 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your UK Dvla D1 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.